Remuneration (REM) is a topic that all human resources professionals will be acquainted with. After all, it needs to be addressed repeatedly throughout the candidate and employee experience.

But that doesn’t mean it’s a straightforward one. It is one of the most complex responsibilities HR is involved with handling. There are numerous considerations—and conflicting opinions—to keep in mind. Unfortunately, this means that those new to handling remuneration can quickly become overwhelmed.

That’s precisely why we created this beginner’s guide to remuneration. We specifically made it to support HR professionals who are seeking additional guidance for how to expertly handle remuneration matters in their workplace. Not only will we define remuneration and other key terms, but we’ll also touch on some important considerations to keep in mind.

Remuneration Meaning: What is Remuneration?

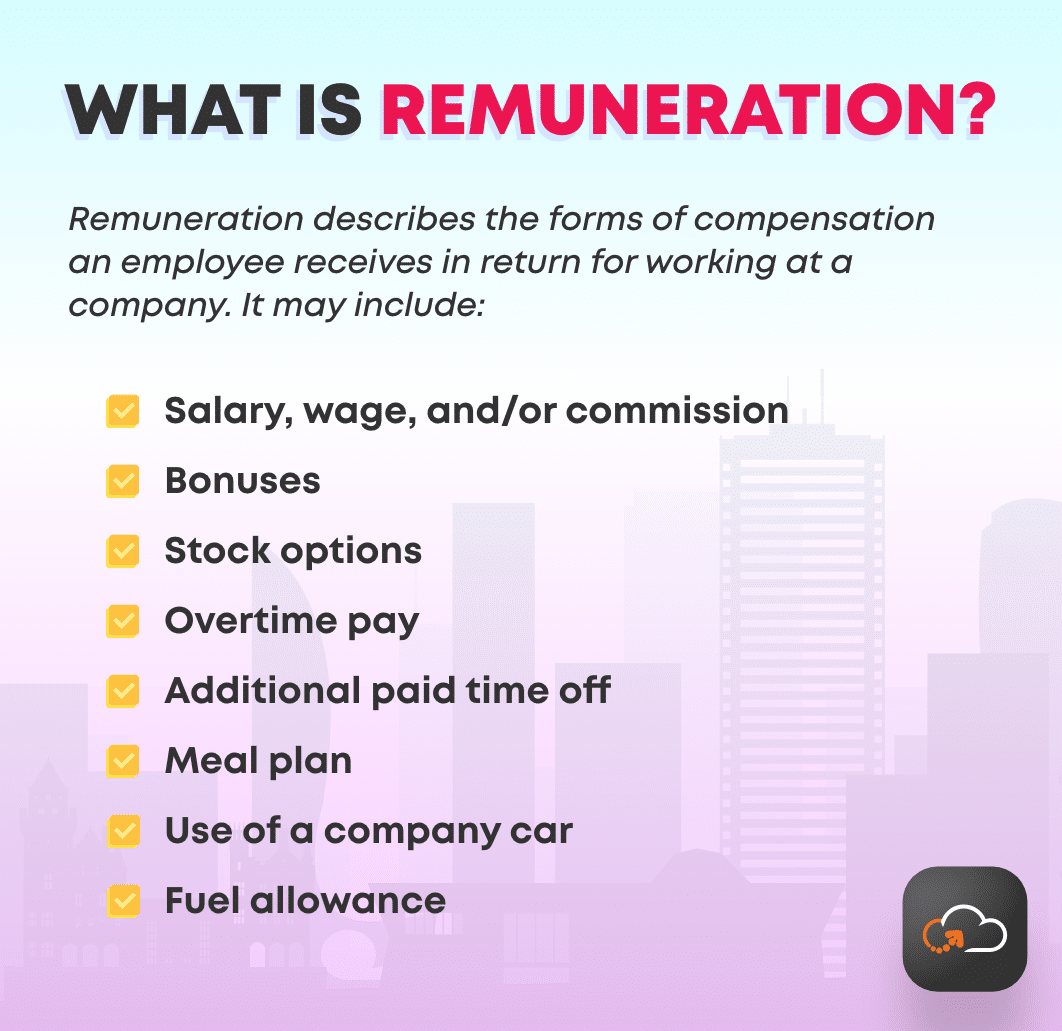

First thing’s first: let’s define remuneration. Remuneration is a term used to describe the forms of compensation an employee receives in return for working at a company.

It may include:

- Salary, wage, and/or commission

- Bonuses

- Stock options

- Overtime pay

- Additional paid time off

- Meal plan

- Use of a company car

- Fuel allowance

- Any other employee benefits

Sometimes, the term ‘remuneration’ is used to refer only to an employee’s salary/wage/commission. In such cases, the term ‘total remuneration package’ may be used to indicate all forms of compensation an employee may receive (e.g. their salary, bonuses, meal plans, etc.).

However, strictly speaking, remuneration already refers to all forms of compensation offered to an employee, not just their salary/wage/commission.

Types of Remuneration

As we touched on above, the term remuneration includes salary, wages, and/or commission. But what are the differences between these forms of remuneration? Below we’ll distinguish these terms from one another and provide an example of each.

Salary

Salary refers to the amount of financial compensation an employee receives on an annual basis for working full-time or part-time at a company. It is usually paid every fortnight or month. An employee is usually paid the same amount on each pay day, regardless of how many hours they worked.

Salary example

Amanda works full-time at ABC Company. Her salary is $84,000 per annum. She usually works 38 hours a week. However, she occasionally ends up working overtime. As she is on a salary, she receives $7000 gross income every month ($84,000 / 12 months), whether or not she works 38 hours or more.

Wage

Wage refers to the amount of financial compensation an employee receives on an hourly basis for working at a company. It is usually paid every week, fortnight, or month. An employee’s wage may change according to how many hours they worked and if any penalty rates apply.

Wage example

Leo works casually as a waiter every Thursday at EFG Cafe. His wage is usually $24.80 per hour, which is the minimum wage rate for Monday to Friday shifts for casual and permanent cafe and restaurant workers aged 20 or older in Australia.

He usually works 6 hours every Thursday, so he receives $148.80 per week ($24.80 x 6 hours). However, this month, he has decided to work one 6-hour shift on Sunday. As the minimum wage rate for Sundays for casual and permanent cafe and restaurant workers aged 20 or older in Australia is $29.76, he will receive an additional $178.02 that week ($29.67 x 6 hours). This means that while he usually receives $148.80 per week, he is able to receive a total wage of $326.82 ($148.80 + $178.02) for the week that he also worked on Sunday.

Commission

Commission refers to the amount of financial compensation an employee receives based on an agreed-upon result. In most cases, the result will be related to selling a certain amount of products or meeting specific sales targets. Those working on commission will usually receive a set amount of money or a specific percentage of the total sales if they can achieve the stipulated result. That is, as long as any other relevant conditions set by the employer are met.

Commission example

Zane works as a sales representative for XYZ Software. He works on a commission basis, earning 10% of every sale he makes. Last week, he sold 100 software packages worth $100 each. This week he sold 20 software packages worth $500 each. That means in the past two weeks he made a total commission of $3000 ((10% x $100 x 100) + (10% x $500 x 40)).

How Do I Work Out What Remuneration to Offer Employees?

We would love to give you a clear-cut answer to this question. However, the remuneration you offer each candidate or employee is dependent on a range of factors.

Salary, wages, and commission

Generally speaking, employers have quite a bit of flexibility regarding salary and wages. That is why you may come across similar salaried positions that vary by tens of thousands of dollars in remuneration, or wages that differ by a few dollars per hour.

Remuneration must meet the minimum pay and conditions of employment set out in relevant legislation.

However, you must always ensure that the remuneration meets the minimum pay and conditions of employment set out in relevant legislation.

All awards, employment contracts, enterprise agreements (an Australian term to describe REM agreements negotiated between a company and its employees or an organised body such as employee unions) or other registered agreements must at least provide for the conditions set out by the national minimum wage or the National Employment Standards (NES).

If there is an applicable modern award, your workplace must also abide by it. For example, The Fair Work Ombudsman notes that “if the base rates of pay in an agreement are lower than those in the relevant modern award, the base rates of pay in the modern award will apply.” The exception is if your workplace is instead covered by a registered agreement. In such cases, the conditions set out by a modern award will not usually be relevant.

In terms of how to pay employees working on commission or piece rates, we recommend referring to this guide by The Fair Work Ombudsman on the matter.

There are many factors you must consider when deciding on an employee’s REM.

In addition to accounting for minimum pay and other conditions of employment set out in relevant legislation, there are a host of other factors you must consider. For example, before deciding on remuneration, you should think about:

- The nature of the role, including the responsibilities and requirements

- Whether the role is full-time, part-time, casual, or contractor

- The years of relevant experience the candidate/employee offers

- The educational background, skills, and qualities of the candidate/employee

- Your budget

- Other types of remuneration you will provide

Other types of remuneration

As mentioned above, remuneration may also comprise other employee benefits. It is up to each company to decide if they wish to offer one or more to employees.

These types of remuneration are often part of a company’s ‘employee value proposition.’ This term encompasses the benefits that employees can enjoy upon starting work or passing their probationary period.

Employers may even offer some benefits to some employees and not others, or may tweak such benefits to each employee. For example, some employees may be offered stock options, while others may not.

Superannuation and 401(k)

In Australia, employers are legally obligated to contribute superannuation contributions of 10% of a full-time, part-time, or casual employee’s ordinary time earnings when they are paid $450 or more before tax in a month and are over 18 years. Employees under 18 years who work over 30 hours a week and temporary residents are also eligible for superannuation. For more information, refer to The Fair Work Ombudsman’s guide.

In the US, there is no legal requirement for employers to contribute to employees’ 401(k). However, many employers choose to either match or pay part of employees’ contributions to their 401(k) accounts. To read a summary on the matter, check out Investopedia’s guide.

How Do I Keep Track of Employees’ REM?

Whether you work in a company with one or one hundred employees, you will need to have a proper HR system in place to keep track of each employee’s REM.

While there are many options to choose from, none compare to how feature-packed and easy-to-use MyRecruitment+ is. Offering end-to-end recruitment and onboarding software for HR leaders, MyRecruitment+ makes staying on top of employees’ REM a quick and simple process.

For example, the request-to-recruit workflow allows you to easily capture all of the vital information about a role that needs to be approved before you begin your candidate search. Once the information is finalised, you can seamlessly send it to your executive team to instantly sign off on.

Another reason the MyRecruitment+ platform is the preferred choice of savvy HR professionals is the organisation chart (org chart) function.

Our enterprise-grade org chart software allows HR, executives, and managers to capture all positions and the reporting lines in an organisation.

“An org chart for an HR team is more than just a pretty representation of the organisational structure for a company/organisation,” says MyRecruitment+ CEO Anwar Khalil. “Our enterprise-grade org chart software allows HR, executives, and managers to capture all positions and the reporting lines in an organisation.”

Anwar explains that the org chart gives HR the ability to design each position that’s present on the org chart including the position’s:

- Remuneration and how it may relate to relevant industry awards or enterprise bargaining agreements

- Job description

- Location of the site of employment

- Department

- Enterprise unit (such as a brand),

- Minimum qualifications

- List of benefits and entitlements

- Roster of the position (especially for part-time positions)

“It will also allow you to factor in any other considerations that should be captured against the position in order to keep everyone on the same page, especially the managers, the executives, and HR.”

Should I Include Remuneration in My Job Ads?

There are many standard components that make up a strong job advertisement. However, it is up to each employer to decide whether or not they wish to include some mention of remuneration in their job ads.

It’s a contentious topic, to say the least. Just browse through job ads on popular job boards and you’ll see that there are HR and business leaders on both sides of the fence. Needless to say, employees also have their own take on the matter!

While most job ads completely omit any mention of salary, there are still many that provide remuneration expectations to candidates (or at least offer a ballpark range).

In order to work out if you should include it in your job ads, weigh up the pros and cons. For example, SHRM argues that putting salary on your job ads can be a key way to gain a competitive edge when it comes to attracting top talent. They highlight that successive studies have shown remuneration to be the biggest motivator for job seekers.

On the other hand, including it can make candidates overly focused on compensation, to the detriment of other job factors. “I prefer not to put it on as it attracts people for the wrong reason,” says Peter Lewis, Senior People & Culture Business Partner at Data Action. “I believe that money should be just one factor, not the deciding factor, for job seekers considering a role.”

Conclusion

The guide above is a must-read for any HR professionals who want to develop their knowledge of remuneration. After reading it, you should have a solid understanding of the key concepts involved, as well as some insights into some important considerations around remuneration.

Want to share your expert advice about remuneration? Comment below!

COMMENTS